Are Pharmaceutical Costs Really Spiraling Out of Control?

It depends on how you look at it… and your strategy.

by Martino Luu, RPh – Executive Vice President & General Manager of HealthSmartRx Solutions

It seems like every week or two I see a new article or a quote from an industry “expert” relating to drug costs and how they are spiraling out of control. But is this really the case? I would assert that this may not be the case. I say this because, contrary to popular belief, the actual results ring of A Tale of Two Cities – it was rising costs (specialty), it was decreasing costs (traditional).

First, let’s talk about decreasing costs. Can this really be true? According to the Express Scripts 2018 Drug Trend report, the commercial segment had a record-low drug trend in 2017. Here’s the good news: traditional drug categories such as cardiovascular, diabetes, high blood pressure, depression, and so on are relatively stable from a cost and pricing perspective. Spending on traditional drugs, which accounted for 59.2% of total spending, actually decreased 4.3% driven by a 4.9% decrease in unit costs and increased generic fill rates of 86.2%.

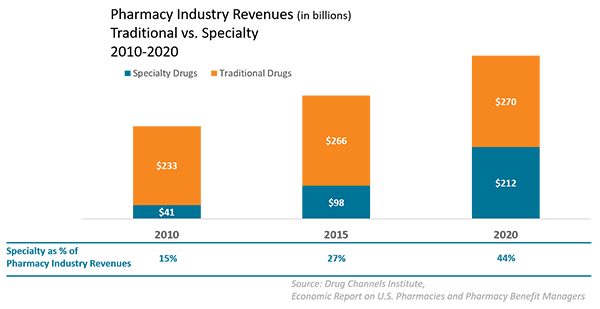

This isn’t to say that there should not be concern about rising drug costs. The greatest area of concern for plan sponsors is the growth of specialty drugs. While only 1-2% of people require specialty drugs, they currently account for roughly 40% of the cost of prescription benefit plans. Spending on specialty drugs increased 11.3% in 2017, driven by a 3% increase in utilization and 8.3% increase in unit costs. And based on the current drug pipeline, specialty drug costs are projected to account for 45% of total drug spend this year. Given that almost all new drugs in development are specialty drugs, we can only expect the percentage of specialty drugs to increase.

The Cost of Gene Therapies

Adding to the complexity, we now have a new drug class, gene therapies, which is capturing attention in recent headlines. Many years after the mapping of the human genome followed by very high optimism, gene therapies are now a reality. These exciting new interventions have the potential to cure patients with genetic disorders that were previously untreatable. One recent example of this is the development of Zolgensma, a treatment for spinal muscular atrophy (SMA). It debuted last year at a cost of $2.2 million. SMA, also known as “floppy baby” syndrome, is a horrific condition where the prognosis of the infant after the age of 3 years is death. Zolgensma doesn’t just treat the condition – it’s a cure for SMA! So far, the U.S. Food and Drug Administration (FDA) has approved a handful of gene therapies to treat serious, but the pipeline of gene therapies is projected to reach between $16-45 billion in the next three to five years.

Medical vs. Pharmacy Benefits

In addition to the growing pipeline of new drugs, there are other factors that contribute to the complexity of specialty medications. A major issue is that specialty drugs are managed in both the pharmacy and medical benefit. The current breakdown is approximate 56% pharmacy and 44% medical, and there are specific challenges on the medical vs. pharmacy benefit:

- The pharmacy benefit has comprehensive utilization and formulary management in place while the medical benefit typically only has basic medical necessity and generalized medical policies

- Pharmacy benefit has robust specialty drug rebates while the medical benefit drug rebates is still an emerging process for manufacturers

- Pharmacy benefit has competitive and defined specialty drug pricing and discounts while the medical benefit has various channels with dramatic different pricing and discounts

What are the strategies that plan sponsors are implementing to control the rise in specialty drug costs?

So what is the best strategy to control costs of specialty drugs, aside from strict utilization management and step-therapies? For our self-insured clients, the best cost control mechanism is the optimization of manufacturer copay assist programs. HealthSmartRx has a program that does just that.

HealthSmartRx Variable Copay Program

The Variable Copayment Program is a benefit design change that allows members to maximize the use of manufacturer copay assistance on select specialty medications which will drive additional payer and member savings. This program requires plans to update their Summary Plan Description (SPD) guidelines, indicating that copays for select drugs will be higher. Members will not solely be responsible for this amount, as the copay assistance program will cover the cost of the medications. Some drugs do require a minimal patient cost share, which ranges from $5 to $25 and is the most a member would pay per fill for these drugs.

In order to achieve savings for members, they will need to enroll in the appropriate copay assistance program, which will be offered by HealthSmart’s Specialty Pharmacy representative.

Example

Under the current plan design, the copay is $35 which is covered by the member. Under the Variable Copayment program, the member’s copay is set to $1,000 ($12,000/12 fills annually); however, their drug has $12,000 available in copay assistance annually and requires member to pay only $10 to cover remaining copay. This drug is filled 12 times per year by the majority of members.

The system is updated to reflect the $1,000 copay, which members will see and will be told is their copay. At the time of fill, a pharmacy representative will explain the member’s copay is $1,000 and the copay assistance available which will reduce the patient’s responsibility. All the member needs to do is agree to enroll in the program and their copay will be $10, which they will be billed for after the drug is shipped.

In this example, the Member saves $25 per fill and the plan saves $965. The $990 copay is covered by the manufacturer assistance program. Both the member and the plan win.

High Cost Drug Management Program

For medications on the medical benefit, plan sponsors will need a comprehensive solution that applies utilization management, medical drug rebates, narrow provider network, copay assist programs, etc. to actively manage specialty drug spend. HealthSmartRx does offer plans sponsors our High Cost Drug Management Program that applies all of these strategies. The program really works. As an example, a HealthSmartRx client saw savings range from 15-17% of total medical specialty drug spend.

Other Strategies

These are just two strategies to address the cost of high-priced specialty drugs. Of course, there are other strategies specifically for very high-cost medications, including:

- Excluding coverage

- Not covering new to market drugs for a specified period of time

- Evolve the role of specialty pharmacies in the procurement of very high cost medical specialty drugs to prevent the “mark-ups” that exists in the current buy and bill process

- Value based contracting that ties the outcome of the therapy to the reimbursement

- “Stop Loss” insurance focused on the novel high cost medications

What Strategy Should You Adopt?

These are just some examples of what others – including HealthSmartRx – are doing to curb costs related to high-cost medications. Unfortunately, there is no silver bullet. Just like many others, we’re working hard to figure things out and develop new strategies. The exciting new is, we’ve already found some highly effective methods of reducing costs, and I expect we’ll continue to find more. So which is the best strategy for you? It really depends on your specific business and your needs. We would love to talk with you about which strategies make sense for your business.

About the Author

About the Author

Martino Luu, RPh is Executive Vice President & General Manager of HealthSmartRx Solutions and responsible for managing pharmacy benefit solutions for HealthSmartRx Solutions. Martino has more than 15 years' executive leadership, which includes senior positions at DaVita Rx, a specialty pharmacy unit of DaVita, the largest provider of kidney care in the country, Diplomat Specialty Pharmacy, the nation’s largest independent specialty pharmacy, and Medco Health Solutions, formerly the nation’s largest prescription benefits management firm. Martino holds pharmacy licenses in New Jersey, Texas, Tennessee and Florida. He graduated from pharmacy school at Rutgers University and completed his MBA in Entrepreneurship at Fairleigh Dickinson University’s Silberman School of Business.